The concept of Materiality has evolved over hundreds of years as a fundamental principle in driving business growth.

Using materiality, organisations have operated for years with the core intention to create value for their shareholders. However if an organisation wants to survive in today’s landscape, it must consider a broader range of stakeholders — such as the people and planet.

This leans into the concept of Double Materiality — which is an evolution of materiality and is arguably one of the most important reporting frameworks to date. This is primarily because it takes into account an organisation’s impact on the planet and people alongside purpose and profit. So without further ado, let’s look at what double materiality exactly means?

What is Double Materiality?

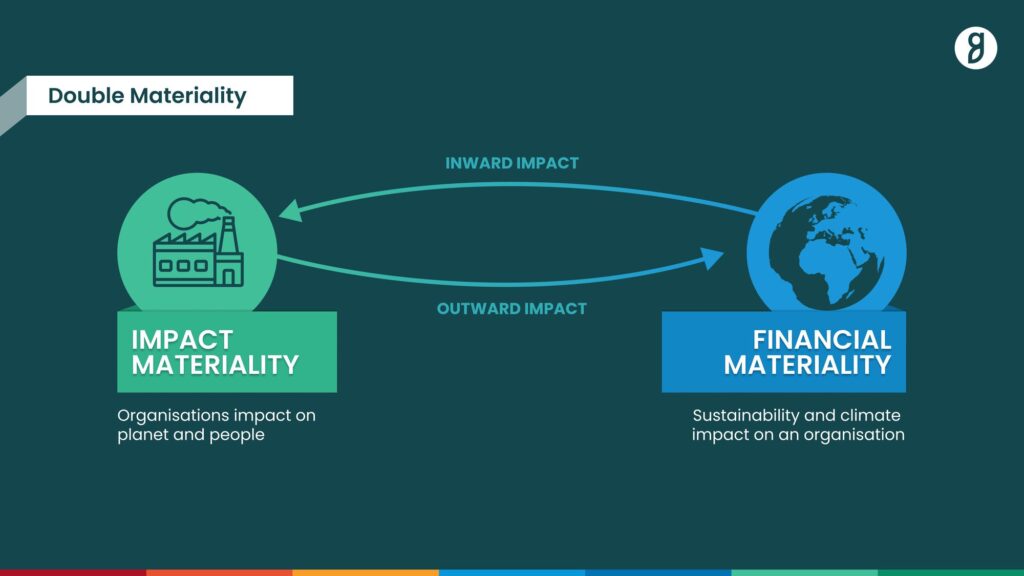

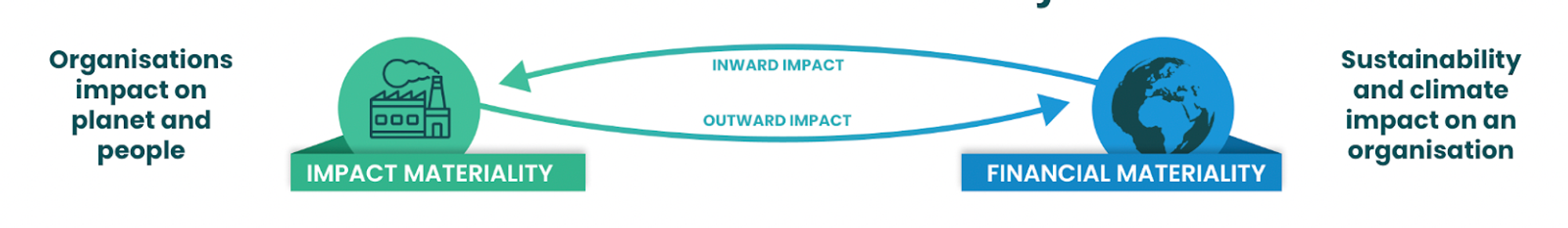

Double Materiality is an advanced framework from materiality itself that evaluates an organisation’s sustainability by considering impact materiality as well as financial. It encompasses two perspectives:

Financial Materiality: This perspective assesses how social, environmental, and external issues affect a company’s financial performance (outside-in perspective).

Impact Materiality: This viewpoint examines how a company’s operations impact society and the environment (inside-out perspective).

By integrating these dual perspectives, Double Materiality ensures that companies report on sustainability matters influencing their financial performance (and risk) as well as considering their broader societal and environmental impacts (and risks).

The Evolution of Materiality to Double Materiality

Historically, materiality in business was largely guided by the International Financial Reporting Standards (IFRS), which focus on financial materiality. IFRS uses defines whether a matter is ‘material’ by how it could substantially affect the organisation’s ability to create value in the short, medium, and long term (Materiality in Integrated Reporting | Integrated Reporting).

The introduction of the Global Reporting Initiative (GRI) standards marked a pivotal shift, encouraging businesses to consider stakeholder perspectives, not just shareholder interests.

Global leaders like Sonja Leighton-Kone from the United Nations Environment Programme (UNEP) endorsed the GRI approach by saying:

“Initiatives such as the GRI are vital to better understanding the impacts of industry and business on the environment. In times of climate crisis, every individual, government, business and organization must step up and we must all hold each other to account as we journey towards a low-carbon, nature positive and sustainable future.”

Sonja Leighton-Kone, Acting Deputy Executive Director, United Nations Environment Programme (UNEP, Kenya)

Global standards such as the European Sustainability Reporting Standards (ESRS) now mandate double materiality assessments in sustainability reporting further consolidating Double Materiality to combine both financial and impact materiality. ESRS advises double materiality be assessed using “appropriate quantitative and/or qualitative thresholds” based on (a) the severity, scale, scope, or significance of impacts, as well as (b) their likelihood. Financial materiality should be based on anticipated financial effects related to an entity or company’s performance, financial situation, cash flows, access to capital, and cost of capital.

According to ESRS:

“The performance of an objective materiality assessment is pivotal to sustainability reporting which shall include relevant and faithful information about all impacts, risks and opportunities (IROs) across environmental, social and governance matters determined to be material from the impact materiality perspective or the financial materiality perspective or both.”

Why Conduct a Double Materiality Assessment (DMA)?

There are four good reasons to undertake a DMA:

A Double Materiality Assessment brings together key decision-makers, fostering strategic insights that inform a company’s sustainability strategy. Aligning business goals with sustainable practices ensures long-term resilience.

- Communicating Sustainability

Conducting a DMA sends a powerful message of accountability and commitment to responsible practices, building transparency and trust with stakeholders, including investors, customers, shareholders, and employees.

- Compliance with Regulations

ESRS and other regulations mandate double materiality assessments, ensuring compliance and reducing legal risks. This framework helps companies stay ahead of regulatory changes, mitigating potential penalties or fines.

- Risk Assessment and Mitigation

Double Materiality provides a comprehensive understanding of risks, encompassing social, environmental, and financial aspects. This holistic view enables businesses to anticipate and mitigate future risks related to regulatory changes, market shifts, and evolving consumer expectations.

Conducting Double Materiality Assessments Using the Lens of the UN Sustainable Development Goals (SDGs)

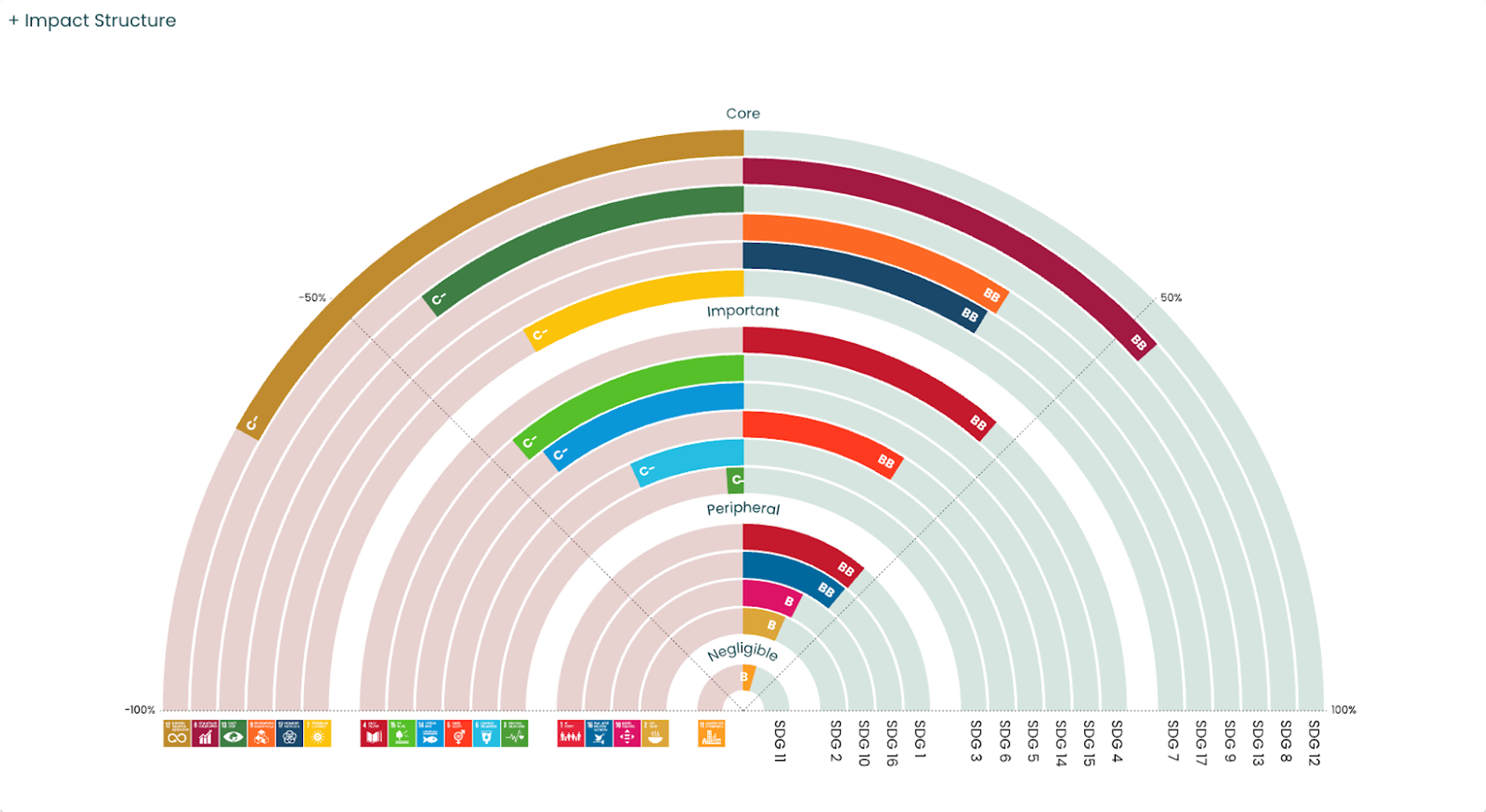

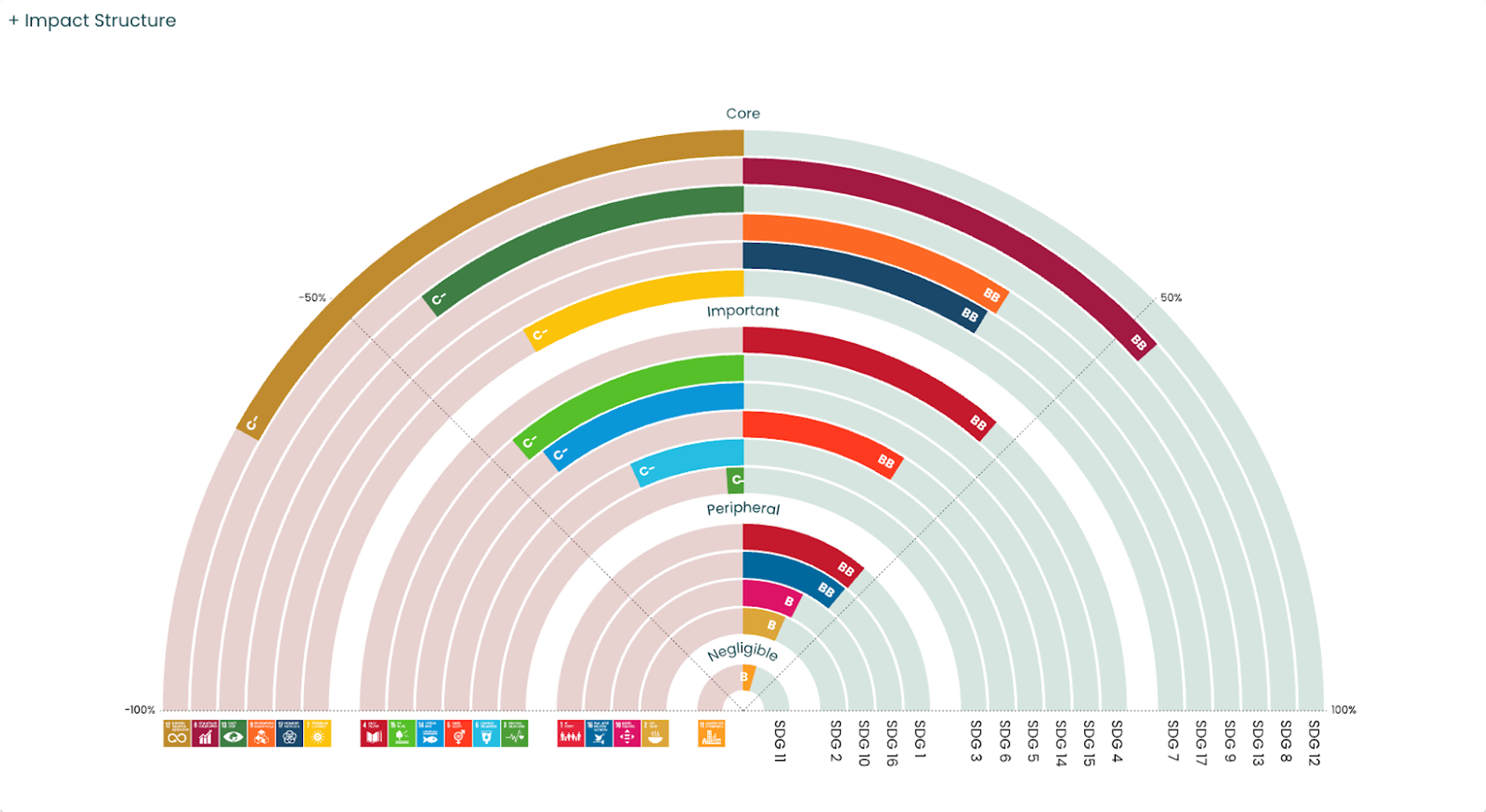

Conducting a DMA against the SDGs brings added benefits of making the output of an assessment digestible to all stakeholders. The SDGs are also the most holistic way to measure impact as they include social, environmental, governance, and economic goals.

Recently, the United Nations Global Compact Network UK released a report which underscored the importance of conducting double materiality assessments in line with the Sustainable Development Goals (SDGs). Titled ‘SDG Showcase: How Companies Are Contributing to Achieving Agenda 2030,’ the report highlights the importance of conducting double materiality assessments against the SDGs to reflect on which areas of sustainability are impacted most significantly by companies’ operations.

The report further notes: “As the SDGs are strongly embedded in Corporate Sustainability Reporting Directive (CSRD) standards, it will prove advantageous for companies to map their SDG impacts across the value chain.”

By engaging with the Global Goals while conducting materiality assessments, businesses can start mapping their operations’ impacts on the SDGs across their value chain and identify impact opportunities.

Paragon’s Double Materiality Solution

Paragon’s Double Materiality Assessment workshops are designed for businesses, advisers, and stakeholders who want to navigate the ESG, impact, and regulatory landscape effectively. By integrating double materiality into your corporate strategy, you drive positive impacts across your company, environment, and society while fostering innovation and resilience.

Why Choose Paragon?

At the heart of Paragon is a cloud based impact management system that makes the sustainability journey easier. It provides:

Access to Comprehensive Modules and Tools: Utilise our dynamic, cloud-based systems for data collection, monitoring, and reporting.

SDG Grading: Align your operations with the UN Sustainable Development Goals for better impact measurement.

Expert Training Materials: Equip your team with the knowledge and tools needed for effective sustainability practices.

By partnering with Paragon, you not only ensure compliance with evolving regulations but also position your business as a leader in sustainability, driving long-term value for all stakeholders.

Interested to learn more about Paragon’s Double Materiality Assessment Training & Workshops and find the best fit for your organisation?

Book a demo call with our Chief Sustainability Officer, Amy King.