In our series on creating change and sustainability, we take a specific sector such as mining, which we agree is not perfect now, to show how the Paragon +Impact approach can lead towards a sustainable future — no matter the state we are in today. Below, our co-founder Brett Wallington talks about how the mining industry is an unexpected catalyst for change in the global energy transition and how impact management can support its transition goals.

Have you ever considered how the road to a sustainable future might begin with mining? The world’s collective movement towards clean energy is fueling an increase in demand for green metals like lithium, copper, nickel and cobalt. These elements are key components of renewable tech such as solar panels, windmill operators and electric vehicles. Producing and supplying these resources in large quantities is important if we want to reduce our reliance on fossil fuels and achieve the global goals by 2030.

Here we see that at one end sustainable mining lies at the forefront of our global clean energy transition. At the other end it navigates strict regulations, geo-political conflicts, bad fellow operators, community backlash and stringent standards.

By 2050, the World Bank forecasts a 500% surge in demand for metals and minerals such as lithium and nickel is required to produce the clean energy technologies in order to meet Paris Climate Agreement goals. But as the global call for sustainability-driven demand amplifies, the mining industry is having to rapidly undergo a transformative shift towards responsible practices as well as to transparently manage and report against this.

Government bodies,lenders and investors are seeking stronger sustainability credentials and ESG performance from mining companies. This naturally presents the sector with challenges, but it also offers it a strategic opportunity to demonstrate its positive net impact and build long term trust with its stakeholders. If the mining industry can get its sustainability act together, it has a chance to position itself as a key sector towards contributing to net positive impact outcomes.

Challenges around changing the mining narrative

The paradox for mining is that while vast volumes of copper, lithium, cobalt, nickel, zinc, manganese and graphite will be required in the coming decade to meet sustainability objectives, mining carries an overall public image of having negative impact on social and environmental outcomes Human rights violation, biodiversity loss, pollution, water wastage are just a few of the issues where mining suffers a shoddy public reputation.

While the mining industry faces issues that it needs to urgently address, it still seems to be grappling with how to get its message across.

So the question remains, how can mining embrace sustainable development and repair its image with the communities, governments and investors?

How do we set the mining sector up for success in providing the minerals essential to a low-carbon transition?

Two words: impact management.

By understanding its current negative impact and risks and defining a clear roadmap for achieving sustainability targets, mining companies can ensure their operations are socially and environmentally responsible — and demonstrate their net positive impact to stakeholders to support and attract the needed capital for growth.

Impact Management in Mining: Aligning Intentions With Net Positive Impact

In order for the mining sector to move towards a sustainable future and achieve net zero targets, mining companies need to align their intentions with substantial action and impact. This is where impact management becomes crucial.

According to the Impact Management Platform, “Impact management is the process by which an organisation understands, acts on and communicates its impacts on people and the natural environment, in order to reduce negative impacts, increase positive impacts, and ultimately to achieve sustainability and increase well-being.”

By adopting the frameworks measuring and reporting their net impact on the society, environment and business goals, mining companies can fast track their transition journey and reach the global sustainability targets.

Let’s delve into the benefits and advantages of adopting Impact Management for mining companies.

Impact managing an evolving regulatory landscape

Governments worldwide are tightening regulations to enforce sustainable mining practices.

In an era of heightened environmental awareness and societal expectations, the mining industry is often under increased scrutiny from both the public and the government. Voluntary sustainability disclosure standards such as GRI, SSB, TCFD and TNFD are becoming mandatory in many countries in Europe and South Africa.

The current regulatory landscape calls for a proactive approach to compliance with evolving regulations. Impact Measurement ensures compliance, reducing legal risks and fostering long-term sustainability.

Compliance with regulations aligns mining activities with environmental standards, minimizing adverse impacts on delicate ecosystems and protected communities. Environment and Social Impact (ESI) Assessments provide a comprehensive view, allowing companies to identify and rectify potential environmental risks beforehand. This not only safeguards the environment and communities but ensures the long-term sustainability of mining operations.

By conducting through impact analysis, mining companies can gauge the social implications of their operations, fostering trust with local communities.

Non-compliance can result in legal repercussions such as hefty fines or suspension of operations, and in certain extreme cases, even time behind bars. Impact assessments and auditable datas serve as a preemptive measure, identifying potential areas of non-compliance and mitigating risks.

The future of sustainable mining hinges on a proactive adherence to regulations and a thorough impact assessment process. Adopting robust impact management methodologies and frameworks enable mining companies to not only navigate the intricate regulatory landscape, but also get into fewer legal disputes and bring forth more stability in their operations.

Consolidating ESG Data & Converting It Into Strategic Insights

Mining operations generate vast amounts of data across various facets.

In the dynamic landscape of the mining industry, the consolidation and structuring of disparate ESG data silos present a serious challenge. Companies often get lost in a sea of ESG data, not sure what to

Impact Measurement streamlines data integration, breaking down silos, and enabling a holistic view of environmental, social, and economic impacts.

Companies embracing integrated data solutions report an increase in operational efficiency and reduction in data-related errors.

Not only that, impact assessments provide a unified lens through which companies can interpret the intricate web of ESG metrics. By integrating their environmental, social, and governance data in one system, companies can define the “SO WHAT” of ESG data and derive desirable outcomes.

This outcomes-driven approach provides the valuable context for a nuanced understanding of each sustainability metric.

With a consolidated data repository, mining companies gain the analytical edge to derive actionable insights that inform business decisions. It empowers companies to discern patterns, identify bottlenecks, and, most crucially, align their operations with the Global Sustainable Development Goals (SDGs).

In essence, impact assessment helps transform the data into actionable strategic insights. This propels the mining organisation towards a sustainable future and can even have the potential in positioning mining as an industry in the pursuit of global sustainability targets.

Improved Investor Relations

Though the mining industry earns significant profits each year, it hasn’t earned equivalent levels of respect from the new-age millennial investors. Investors are increasingly becoming drawn to projects making a positive difference, fostering sustainable development, and contributing to global ESG objectives.

Conversely, they are refusing to invest in extractive industries such as fossil fuel and mining as many believe these industries don’t align with their priorities.

Poor sustainability credentials can act as a significant deterrent in attracting investment, causing reluctance in lenders or investors to provide loans or funding. Investors are also pushing for tougher sustainability policies. In response, the Global Investor Commission on Mining 2030 plans to introduce sustainability standards by 2024, focusing on waste management, biodiversity protection, child labor and the role that conflict minerals play in financing armed strfe.

Impact management presents a transformative solution in this regard.

Through meticulous impact reporting, mining companies are able to demonstrate the positive social impact they generate, simultaneously identifying opportunities and proactively mitigating risks. By embracing impact analysis methodologies, these companies not only improve investor relations but fortify their credibility in the financial landscape.

Impact reporting serves as a compelling tool to narrate a mining organization’s commitment to sustainable practices, positioning them as attractive prospects for ethical impact investors.

This transparency not only fosters trust – it aligns with the emerging trend of responsible investing. As a result, mining companies with robust impact management mechanisms find it easier to access capital consistently.

Lenders and banks are increasingly prioritising sustainable projects. Impact Management boosts a company’s creditworthiness — opening doors to better funding and loan financing opportunities. Through identifying new avenues for growth, it equips mining companies to qualify for sustainability-linked loans, secure lower interest rates, and navigate Know Your Customer (KYC) requirements, enhancing their financial standing.

Improved Relations with Local Communities

Mining operations have a phenomenal impact on local communities. The mining industry often faces public skepticism due to environmental concerns. Impact management enables mining companies to address these issues head-on, rebuilding public trust.

Impact measurement and reporting stand as powerful tools for mining companies to navigate the delicate terrain of public perception and community relations.

In a sector often criticized for its environmental and social impact, transparent reporting and demonstrating a company’s net positive impact becomes an instrumental tool for repairing public image and averting conflicts with local communities, environmentalists, and Indigenous people.

Through impact reporting, mining organizations can vividly showcase their positive social contribution — from job creation, education initiatives to community development projects. They get to control the narrative and communicate their growth story to the stakeholders.

By communicating their progress with transparency, companies not only foster trust — they mitigate potential future conflicts that might hinder operations.

This proactive approach not only elevates the industry’s overall reputation. It positions mining companies as responsible stewards committed to social and environmental well-being.

How Paragon +Impact Helps Mining Companies With Impact Management

Paragon +Impact’s cloud-based impact management and reporting platform helps mining companies bridge the gap between intentions and action.

Designed by sustainability experts as the home for impact management and reporting, our platform helps you measure, track, report and communicate your net impact against the UN SDGs — while identifying growth opportunities and mitigating risks. With an approach that is collaborative, data-driven and scientific, our sustainability experts support mining companies in understanding and improving their impact across all facets, from policy implementation to devising a sustainability strategy for improved business outcomes.

We work in closely with our clients, which are a mix of industry leading advisors and companies, helping them across every stage of their impact journey. The collaborative process begins with materiality workshops, where stakeholders determine the most crucial aspects guided by sustainable development goals (SDGs). Paragon +Impact’s Environment & Social Impact Assessment methodology involves a structured impact analysis, assigning weight to material issues, and grading the company’s net impact against the SDGs.

As a result a mining company using Paragon +Impact for accreditation has the following benefits”

- Compliance with Regulations:

Mining companies navigate a complex web of global standards and regulations. Paragon +Impact’s SDG grading system has all the major global frameworks embedded (GRI, SDG, TCFD, CDP) for evaluating and prioritizing the most crucial aspects of a mining operation’s impact. Thus ensuring a comprehensive approach towards regulatory compliance.

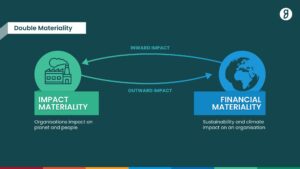

- Double Materiality Assessment:

We start with intensive materiality workshops with executives that identify core material issues considering the dual perspective of a mining company’s impact on the environment and society, as well as the risks posed by external factors.

- Aligning with Sustainable Development Goals (SDGs)

We help identify and prioritise the SDGs which are material to the organisation. Our sustainability experts then formulate a robust strategy to achieve the global sustainability targets and support transition to Agenda 2030.

- Data Management & Impact Analysis

Impact assessments streamline the collection and analysis of company-wide ESG data across various layers of the organisation – from the mining sites to the business and governance. This helps companies navigate the vast landscape of sustainability, ESG (Environmental, Social, Governance), and SDG-related information.

- Impact Grading & Evaluation

Guided by our ESI environmental social impact assessment methodology in conjunction with the SDGs and Impact Management Project (IMP), our experts then conduct impact analysis to interpret the data to gain actionable insights for business outcomes. As a result of that process, we come out with an impact Grading across a number of levels — from areas of negative impact to significant positive impact.

Case in Point: Continuous Iteration & Strategic Value for Ivanhoe Mines, South Africa

While early results are still unfolding, Paragon +Impact’s ongoing partnership with clients like Ivanhoe Mines highlights the potential for continuous improvement and iteration. Through impact measurement and assessment, the company gained strategic insights to address environmental and compliance challenges, improve social impacts, and strategically position themselves for sustainable growth.

Navigating the Future Through Insightful Impact Management

Mining plays a crucial role in what the future looks like. A future where responsible, and timely, sourcing of green metals will be paramount.

As mining companies embark on the journey towards sustainability, the role of impact management becomes a guiding compass. By demonstrating their net impact and going beyond ESG to derive actionable outcomes, mining companies can safeguard their social license to operate and set an industry standard for competitors.

The future of sustainable mining is intricately tied to the effective implementation of Impact Management. Beyond compliance, it is the cornerstone for fostering positive relationships, mitigating risks, and unlocking new avenues of funding and capital.

As the mining industry evolves, embracing Impact Management is not just a choice; it’s a strategic business advantage — one that propels us toward a sustainable, equitable future.